Friday Aug 1, 2014:

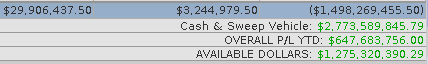

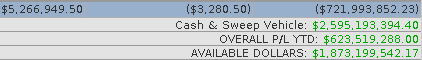

Getting a sharp recovery at the opening bell that is still going fast 15 minutes later up 35 million and rising. Here is close to the opening bell.

SPX 1929.77... Oh the irony. The Great Crash of 1929. The lowest price was 1925.41 so far at the open. At 10, a half hour in, we are at 1936.1 but with weakened strength to the recovery... a pause.

We can do the analysis of why the hedge broke a bit to the downside over the weekend, but in a word, Volatility. Yet VIX is only in the 14's. It has had a couple times over the last year in the 20's. At 10:30, we are into the choppy action. By 11:30 VIX is up to near 17. Still lot's of room to go there.

See how I suck in all the Conventional wisdom yet? Hint: It is Mo Money than

you can guess: I am a bad girl! Worse than that... The Boss is fighting lyme disease. He is winning with his pets... A couple deer and their mother. He sure knows the other side of our trades more than they know themselves! The Boss STOLE my stash!!!! Worse yet .... I am his hedged .... I May not have sucked you in, but Ya gotta pay his piper. I am not gonna quit. He is best Dad EVAH!

Every time I have a loss, rarely, I just go to The Boss, my Dad. He had the foresight to save and hedge my shenanigans. They say his IQ is 154 but that is classified because he works in Energy. You cannot tell the speculators where he has been. But he has pretty much been everywhere.

Sorry boss has me busy on secret project. That's hedging inside the hot pocket.

It will not let me show you. That means that I am It now. SEC Rules Apply. Total at risk: 20 Trillion

Total Invested: 0 Trillion

In My defense, it is my Boss.

He just poured me some of his Sammy Hagar Anejo. It must be good. How Good? Just imagine the other side of all your trades.

While we wait for my aide of the hedge to close, that is like the best Tequila EVAH! It tastes like Lymes and salt too.

I feels butthurt an' itchy now. He used us. That bastard. At least I have a paycheck.

Truth be told I would have quit long ago if he wasn't such a good fuck, and a wise old sage.

it won't let me show U. I suspect the SEC but The Boss crushed us

The Boss says if they stole Veritas from him, who is really Veritas?

If they jacked that, who knows? You always let the camera man down first DUHHHH!

Thursday Update:

My Sunday sunburnt butt is itchy as we wait for a down opening with SPX/ES losing overnight 1965-1951... 14 handles. Hope that I applied enough Bear Repellant Mace. We will see.

A hard down opening for sure. That is the trouble with bears. You have to spray them, not yourself, when they show up. But I imagine it could be ten times worse for those who are unhedged. Actually now could be a fantastic time to shop, or we can wait it out. We have about 1,334 of dry powder after all. Volatility S+P and Gold Miners in Value, but are we too tired to do anything about it, being all itched out. Spreads could just be wider from increased volatility which won't or hasn't lasted all that long before.

Finally! We've been waiting it out till Lunchtime, and Our First Big Down Day in several Months! Now is this the opportunity of a lifetime or the beginning of the end? So much volatility to micro analyse. I should scratch my butt and file my nails a bit more though. It is a bad time of day for a correction.

The Boss just sent me the weirdest txt. He said the deer are eating his Apple Trees. I guess they are Herbivores. But he also said something about an old medicine man telling him that nothing runs like a deer! Well, at least they don't seem to have a problem with Lyme Disease and Borelliosis. People? Not So Much. I wonder if they have a problem with sunburn? Ticks think people taste like candy because they eat sugar too. Bugs also prefer non smokers. But I digress... <puffs cigar>

Remember how we told you all about Interest Rates? Sure spooked all the rocket scientists because they knew about this dagger hanging over our head for a long time. Add Hedgers to the Interest Rate Haters. XIV would see the thirties again if not the teens! Ouch! Janet dropped the bomb they will say. Rho Indeed.

SPX has printed 1937.46. That is sort of like the Great Depression sequel annualized back when Hitler was working on improving his Joo Roaster, but of course Rule 2 is no matter how bad things get they can always get worse. This time, Hamas will reinvent the skid with similar results. Caveat Emptor.

The Close is Ugly, but we'll make it back in spades. Tomorrow Black Friday.

Wednesday Update:

Getting a sharp recovery at the opening bell that is still going fast 15 minutes later up 35 million and rising. Here is close to the opening bell.

SPX 1929.77... Oh the irony. The Great Crash of 1929. The lowest price was 1925.41 so far at the open. At 10, a half hour in, we are at 1936.1 but with weakened strength to the recovery... a pause.

We can do the analysis of why the hedge broke a bit to the downside over the weekend, but in a word, Volatility. Yet VIX is only in the 14's. It has had a couple times over the last year in the 20's. At 10:30, we are into the choppy action. By 11:30 VIX is up to near 17. Still lot's of room to go there.

See how I suck in all the Conventional wisdom yet? Hint: It is Mo Money than

you can guess: I am a bad girl! Worse than that... The Boss is fighting lyme disease. He is winning with his pets... A couple deer and their mother. He sure knows the other side of our trades more than they know themselves! The Boss STOLE my stash!!!! Worse yet .... I am his hedged .... I May not have sucked you in, but Ya gotta pay his piper. I am not gonna quit. He is best Dad EVAH!

Every time I have a loss, rarely, I just go to The Boss, my Dad. He had the foresight to save and hedge my shenanigans. They say his IQ is 154 but that is classified because he works in Energy. You cannot tell the speculators where he has been. But he has pretty much been everywhere.

Sorry boss has me busy on secret project. That's hedging inside the hot pocket.

It will not let me show you. That means that I am It now. SEC Rules Apply. Total at risk: 20 Trillion

Total Invested: 0 Trillion

In My defense, it is my Boss.

He just poured me some of his Sammy Hagar Anejo. It must be good. How Good? Just imagine the other side of all your trades.

While we wait for my aide of the hedge to close, that is like the best Tequila EVAH! It tastes like Lymes and salt too.

I feels butthurt an' itchy now. He used us. That bastard. At least I have a paycheck.

Truth be told I would have quit long ago if he wasn't such a good fuck, and a wise old sage.

it won't let me show U. I suspect the SEC but The Boss crushed us

The Boss says if they stole Veritas from him, who is really Veritas?

If they jacked that, who knows? You always let the camera man down first DUHHHH!

Thursday Update:

My Sunday sunburnt butt is itchy as we wait for a down opening with SPX/ES losing overnight 1965-1951... 14 handles. Hope that I applied enough Bear Repellant Mace. We will see.

A hard down opening for sure. That is the trouble with bears. You have to spray them, not yourself, when they show up. But I imagine it could be ten times worse for those who are unhedged. Actually now could be a fantastic time to shop, or we can wait it out. We have about 1,334 of dry powder after all. Volatility S+P and Gold Miners in Value, but are we too tired to do anything about it, being all itched out. Spreads could just be wider from increased volatility which won't or hasn't lasted all that long before.

Finally! We've been waiting it out till Lunchtime, and Our First Big Down Day in several Months! Now is this the opportunity of a lifetime or the beginning of the end? So much volatility to micro analyse. I should scratch my butt and file my nails a bit more though. It is a bad time of day for a correction.

The Boss just sent me the weirdest txt. He said the deer are eating his Apple Trees. I guess they are Herbivores. But he also said something about an old medicine man telling him that nothing runs like a deer! Well, at least they don't seem to have a problem with Lyme Disease and Borelliosis. People? Not So Much. I wonder if they have a problem with sunburn? Ticks think people taste like candy because they eat sugar too. Bugs also prefer non smokers. But I digress... <puffs cigar>

Remember how we told you all about Interest Rates? Sure spooked all the rocket scientists because they knew about this dagger hanging over our head for a long time. Add Hedgers to the Interest Rate Haters. XIV would see the thirties again if not the teens! Ouch! Janet dropped the bomb they will say. Rho Indeed.

SPX has printed 1937.46. That is sort of like the Great Depression sequel annualized back when Hitler was working on improving his Joo Roaster, but of course Rule 2 is no matter how bad things get they can always get worse. This time, Hamas will reinvent the skid with similar results. Caveat Emptor.

The Close is Ugly, but we'll make it back in spades. Tomorrow Black Friday.

<3

Wednesday Update:

It is actually after Tuesday Close, but I will start early. Some wannabe hedger blew up one of our underlying Hedge Pairs after hours, Peas be On Him. It will rectify at opening, or ProShares goes Plowshares. It could happen and now they have the white hot spotlight. The Arbitrators will eat them for breakfast otherwise or either way. Hedging has that built in safety factor. We already turfed them over a week ago. Remember that big Brazil hedge blow up back when they were all fartin' rainbows and we caught 'em with Cupcakes? They got walloped to all zeroes by expiration and simply added more to our already enormous take. I could show you how, but been there, done that, tossed the T Shirt. That's SOOOO last month.

There is also a link describing what I said again last week. A faithful reader hedger or friend of same got bumped on CNBC talking about EMP risk from a Carrington Event solar flare or other. You heard it here first though as we have it included in our Hedge Risk Discussion about overall Model Risk Etc. The original source was Nat Geo and NASA via Weather Network. Washington Post was the latest reminder.

There is also a link describing what I said again last week. A faithful reader hedger or friend of same got bumped on CNBC talking about EMP risk from a Carrington Event solar flare or other. You heard it here first though as we have it included in our Hedge Risk Discussion about overall Model Risk Etc. The original source was Nat Geo and NASA via Weather Network. Washington Post was the latest reminder.

The astonishing opening was getting back the other side of the Volatility hedges. After a half hour trading, the Volatility hedges have reversed their imbalance completely and switched sides for a whopping bank windfall in commish trading fat future spreads to back the options. Trust me you don't want to see the Sausage Factory... Here... Have another Nuts an' Guts Hot Dog special! Would you like extra Anus an' Sauerkraut on that one? Hey don't complain! Most people would give their Eye Teeth to have an eyeball on their's! I know the cow gave its Eye an' Gums.

Stuff like this happens every FOMC Meeting day it seems before Janet gives her Free Hot Dogs out at the Fair.

After 1 hour of trading, gave back a little, but there is a Fed Press Conference in 4 hours. More craziness to follow.

Here it is pre Janet at 2:30:

We are still sitting on Hands. My hands are sore and my butt is sunburned from skinny dipping in river. Owww!

Stuff like this happens every FOMC Meeting day it seems before Janet gives her Free Hot Dogs out at the Fair.

After 1 hour of trading, gave back a little, but there is a Fed Press Conference in 4 hours. More craziness to follow.

Here it is pre Janet at 2:30:

We are still sitting on Hands. My hands are sore and my butt is sunburned from skinny dipping in river. Owww!

Wednesday 3 PM after the Fed and nothing has changed. Still SOH. We may get the spreads back as closing comes up. The Boss gave me a bag of alcohol crushed ice snow and my butt is *Heavenly* right now...

It's wrap. Tomorrow watch interest rates be all the rage. How low can u go? Who0ps! Gotta crik in my back on that last limbo... Help me I can't get up!

<3We have a slight positive opening on the SPX around 1979. Hedges holding weak, slightly up. Too early to say, but they have already called for a choppy "inside" type of day. After about 5 minutes...

An Inside day means it will be bound within a flat defined range. They have no idea really so everybody hedges this mess, the most hated Inflation Rally in history. I added the inflation part since they can't bring themselves to state the Fed Up obvious of printing a boatload of cushy government union pension cheques. At least the sedentary lifestyle will whack them quick after an early retirement, or the shock and stress of a real job like this will off 'em desperately needing more more more.

Hardly a half hour in we have been up 5 million and back. Looks like they did not learn their lesson yesterday, as all that volatility friction adds up on our bottom line when they have to pay the piper at the closing bell. Smart traders holding a winning position may get thrown a bone for once here, but it all may get walloped due to the FOMC Meeting starting this AM. Consumer confidence came in positive so far. 2000 here we come maybe until the reality shock, but so far it went Doji. That means split. But it actually floated up from there. A 45 minute up date now...

Almost 10 million up. I guess they have capitulated to try to stop beating themselves up with Financials down again for the second day. That is the whole Aikido thing I have been talking about. GS is calling for 3 months of chop with high likelyhood of a correction or the like. Some traders vehemently disagree. We don't care as long as they keep duking it out. The Fed will keep 'em going. The certainty of uncertainty, our chosen topic, remains unchallenged by all but the most narcissistic schmucks.

This is where we should consider all these people with their charts leading even more blissful Past Performance disciples. They are a market force to be reckoned with, much like a kindergarten armed with bazookas. God bless them. They are a never ending source of market action (see above.) All the weight of those trades is what moves the markets as they battle it out, Chart A vs. Chart B vs. Chart C. What is even better is that they are so blissful about it, and that they will fight it out as witnessed by none less than Goldman Sachs calling market direction. Channels, Trendlines, Pivots, and More (shhhh! Fib Retracements)! crap than you can shake a stick at. Yesterday they actually had something useful which was a discussion of Option Pricing related to liquidity although it was all pretty much old hat. Watch those spreads!

Every month we wait with baited breath for the FOMC and the presser tomorrow afternoon. It is because it's always a little bit volatile around Fed announcements. Who knows where the charters will try to take the markets? At that time we could try to take advantage of that volatility and later volatility to put on some September positions for a little long term hedging. Last month we went to zero or close to demonstrate what happens with expiring ITM options. Subsequently it is hard to invest this large a sum all at once. We still maintain that maximum option decay is in the last 28 or so days, but 90 days is the hump on that volatility surface. 52 days approaching 45 would be safe too on the downside of the parabola, so in the upcoming week we may open some September things earlier on Volatility bumps.

I had a Twitter. Haven't been back. Probably dead now. They have earnings coming. Who cares?; They suck and pretty much always will. People will make and lose fortunes trading a nothing. Meanwhile through lunch the herd has been racking the SPX. Look at the predictability of that! It's a gong show.

It seems that they select Fed Chairs these day for blandness. Hard to read, yet people will still try. Alan Greenspan was a wild man in comparison.The broken clocks will trumpet their accuracy on the Witching Hours twice daily. Same old.

So what happened? Idiot in Chief spoke to the loving masses. 10 minutes to the closing Bell.

Now the settlement. I suspect LIBOR bagging but we will see. They outted themselves. Did Little 'Ol Me do that? Doubt it. Yesterday didn't work so well so they have resorted to after hours. Karma is a bitch, yet we ae still up. See you tomorrow to watch the action after the Mother of All Vol dropouts crushed SVXY by spreading options to where you could move a house through them. Wait for the long side to play catchup.

Monday Update:

After being through a weekend of blatant Hamas and Russian propaganda and Facebook posts of the same, back to the real world. Perhaps all those people should go to Donetsk-Kiev and Jerusalem to give us something a little less one sided that we can get wrapped around. As it stands, their ignorance is the only astonishing thing I see. What do we care though? ES futures are down at about 1970 on Sunday evening.

Here it is July 28-Aug 1, 2014. Lots of Fed stuff like FOMC Meeting starting Tuesday that will shake the markets. Jobless claims Thursday. The total reflects a weekend of time decay. SPX opened down in the 1979 range.

Home sales came in down 1.1 M versus +0.8 expected. Hedges held with Volatility 1+2 taking a hit as SPX transits the +/- mean. Financials also breaking negative. At about 10:10, there is bearish sentiment overall. S+P hedges down slightly as the market continues a rush to the exits. Dallas Fed Report coming at 10:30 may mean we are heading for a rare down day and an opportunity to add some position on the lower hedges. We did add some to Volatility 1, S+P 3, and Financials on what was the apparent bottom around 10:30.

Gold and Silver Miners have been carrying the flock while all that happened. We are back on a rough up trend through SPX 1972 after a rough hour of mixed trading. They later got hit a bit, but have returned, since taking the whole hedge portfolio lower over lunch. At 2 PM, there is a bit of a wobble to the uptrend. Thinkorswim Swimlessons has given us hedgers a nod regarding Who are those buyers contrary to the market? We effective own a bit of both sides of course to dilute it down to a simple balanced smooth battle where time is on our side.

Now approaching the final hour...

So there is the whole day to now. Hedges back to where we started carrying out the daily dip buying. That curve has been rough on the financials as VIX peaked earlier in the day printing a VVIX of 83.7. They rattle the hedge cage with volatility that way but we have held out as the vega balance gets tested.

At the bell there was an inexplicable sharp rise as all their chickens came home to roost trying to fight the hedges. FAIL! As they tried to balance the close, it all seemed to come home to us. We will have to see if they ever try that dumb move again, and get doubly walloped due to the huge leveraged effect of all the hedgers across all the underlying assets. Now we wait for 15 minutes while it all finalizes.

A rough day, but we stuck to our guns through imbalances and volatility storms. It looks like most of the other hedgers did too, and likely took advantage of the multiple dips we saw as well further confounding the American Greed contingent that tries to guess direction or steal because they are too perplexed to figure out how to hedge it.

<3